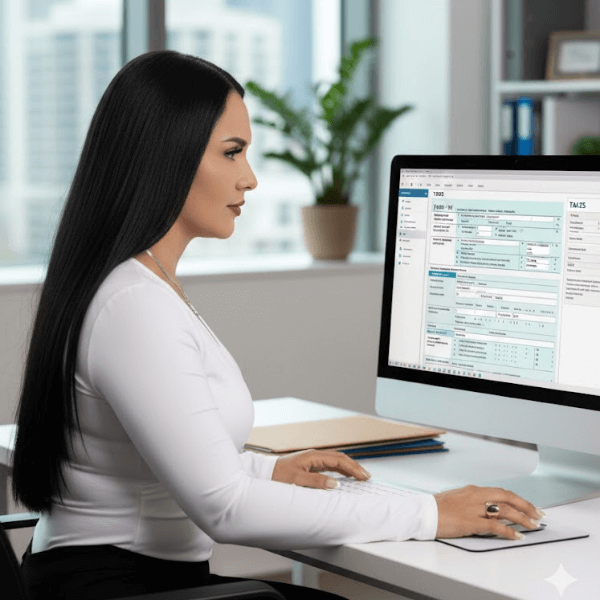

Expert Tax Strategy Consultation

Professional Tax Planning with Johanna Morales, EA

Your Tax Strategist: Johanna Morales, CAA, EA

IRS Enrolled Agent Harvard Business School Online $1M-$5M Business Specialist

Professional Tax Strategist and IRS Enrolled Agent specializing in advanced tax planning, corporate taxation, multi-state payroll, and federal compliance. Get expert guidance tailored to businesses generating $1M–$5M annually.

$200 USD

One-Hour Strategy Session

Applied as credit toward your tax preparation service

Secure payment via Stripe • Schedule after purchase

Happy Clients

Experts Staff

How It Works

Get your expert tax consultation in 3 easy steps

Purchase Consultation

Click the button and complete your secure $200 USD payment via Stripe. You'll receive instant confirmation.

Schedule Your Session

After payment, Stripe will redirect you to our scheduling page. Select your preferred date and time for your 1-hour consultation with Johanna.

Get Expert Guidance

Meet with Johanna for your comprehensive tax strategy session. The $200 will be applied as credit toward your tax preparation service.

Your Investment Works for You

The $200 consultation fee is not an additional cost—it's applied as a credit toward your complete tax preparation service. You're getting expert strategy advice while making progress on your tax filing.

Years Of

Experience

Elite Tax Strategy for Growing Businesses

Johanna Morales is a professional Tax Strategist and IRS Enrolled Agent specializing in advanced tax planning, corporate taxation, multi-state payroll, and federal compliance. Currently completing her Financial Accounting Certificate at Harvard Business School Online (graduating December 2025), she brings elite-level academic training combined with technical expertise.

She exclusively works with business clients generating between $1M and $5M per year, focusing on high-impact tax strategy and advanced corporate planning. As an EA, she represents clients before the IRS in audits, appeals, collections, and complex tax matters.

-

Community & Mentorship

Access experienced mentors and an educational program to develop skills and earn by becoming a trainer or mentor.

-

Expert Tax Services

Professional preparation and ongoing support to ensure accurate, compliant tax filing for individuals and small businesses.

-

Payroll Made Simple

Automated payroll, tax payments, and reporting to keep your team paid and compliant.

Professional Taxes & Payroll Services For Businesses

Tax Planning

Strategic tax planning to minimize liabilities and maximize refunds for individuals and businesses.

Personal Tax

Individual tax preparation and filing with year‑round support and audit assistance when needed.

Insurance Tax

Navigate health insurance deductions, premium tax credits, HSA strategies, and business insurance tax optimization.

Corporate Tax

Corporate tax compliance and advisory for small and medium businesses, including planning and representation.

Tax Software

(Powered by Lunitax)

Industry-grade, cloud-based tax preparation software designed for professional tax preparers. Complete with unlimited filing, comprehensive banking solutions, and nationwide coverage.

Unlimited 1040 Filing

File unlimited returns with no restrictions

Cloud-Based Platform

Access anywhere, anytime securely

Banking Solutions

Integrated financial management tools

All 50 States Included

Complete nationwide coverage

Professional Tax Software

Unlimited Filing

Cloud Platform

Mobile App

All States

Powered by Lunitax - Industry-Leading Tax Technology

Book Your Expert Consultation Now

One-hour strategy session with IRS Enrolled Agent Johanna Morales—$200 applied as credit toward your tax service

Tax Strategy Consultation

with Johanna Morales, EA

- 60-Minute Expert Consultation

- IRS Enrolled Agent Guidance

- Tax Strategy & Planning

- Business Tax Optimization

- Compliance Review

- Action Plan & Next Steps

- $200 Credit for Tax Service

Schedule your appointment after payment

Expert Tax & Payroll Solutions to Streamline Your Business

We combine professional tax and payroll services with easy-to-use software to save you time, reduce errors, and ensure regulatory compliance. Let our experts handle the numbers so you can focus on growing your business.

Book Consultation Now - $200Our Awesome Features

Trusted Tax Expertise

Accurate, compliant tax preparation and strategic advice that reduces liabilities and protects your business.

Secure Payroll & Payments

Reliable payroll processing and timely tax payments with bank‑grade data security.

Experienced Team

A dedicated team of tax and payroll professionals with decades of combined experience.

Reliable Support & Compliance

Ongoing support, regulatory updates, and compliance assistance to keep operations running smoothly.

How LuniTax Works

Choose Your Service

Select the service you need — Taxes, Payroll, or both — and schedule an initial evaluation.

Consult Expert Staff

Meet with our tax and payroll specialists to review your documents, compliance needs, and goals.

Strategic Work Planning

We create a tailored plan that covers filings, payroll setup, timelines and deliverables.

Completed Work

We implement the solution: file taxes, run payroll, and provide ongoing support and updates.

Expert Tax & Payroll Services You Can Trust

Practical, compliant tax and payroll solutions tailored to small businesses and tax preparers. We combine experienced advisors with simple software for predictable results and ongoing support.

Cost-Effective Pricing

Transparent plans that scale with your needs — clear fees with no surprises.

Growth-Focused Support

Mentorship, training and marketing help for new preparers — grow your practice while delivering great client outcomes.

Secure Savings

We identify tax savings and streamline payroll to protect cash flow and reduce risk.

What Our Client Say's about us

Real feedback from businesses and individuals who trust LuniTax for their tax and payroll needs. From small startups to growing enterprises, our clients value accuracy, support, and peace of mind.

Know MoreReady to Optimize Your Tax Strategy?

Book your $200 expert consultation with IRS Enrolled Agent Johanna Morales today. Get personalized tax strategy for your $1M-$5M business—and apply the full $200 as credit toward your tax preparation service. Schedule immediately after secure payment.

Secure payment via Stripe • $200 credit applied to tax service