Community & Mentorship

Access experienced mentors and an educational program to develop skills and earn by becoming a trainer or mentor.

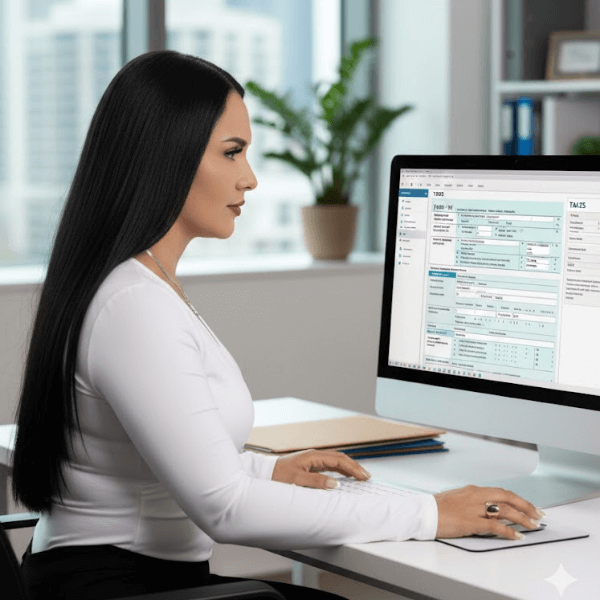

LuniTax is more than a tax program — we are a community of tax preparers and small business owners. We provide professional tax services and payroll solutions, plus a user-friendly software that supports your operations. New preparers receive mentorship, guidance, and marketing support to grow their practice.

Access experienced mentors and an educational program to develop skills and earn by becoming a trainer or mentor.

Professional preparation and ongoing support to ensure accurate, compliant tax filing for individuals and small businesses.

Automated payroll, tax payments, and reporting to keep your team paid and compliant.

It is a long established fact that a reader will be distracted by the readable content of a page when looking at its layout. All the generators on the Internet tend to repeat predefined chunks.

Know More